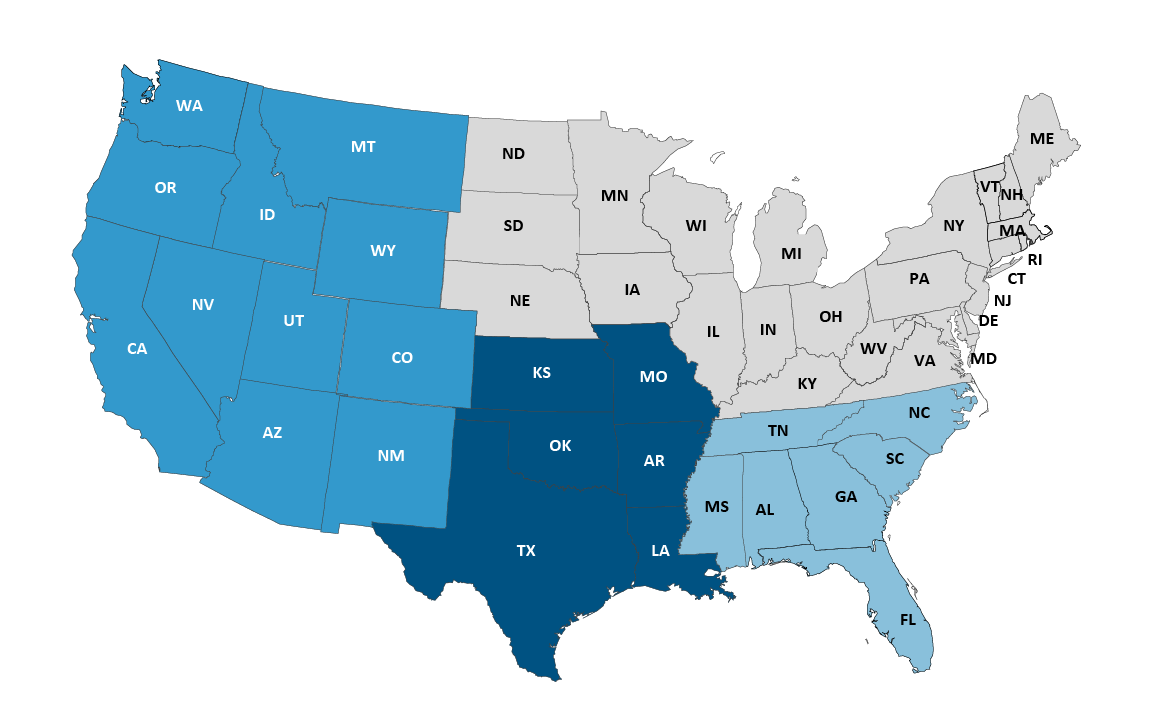

GFS - Sales Territories

Interact with the colored regions to see related contact information. You can also contact Customer Service at graybarfinancial@graybar.com and 800-241-7408.

Testimonials

Simplified Financing Options

Energy-Efficient Lease

An energy-efficient (EE) lease from Graybar Financial Services can help finance everything from lighting retrofits and building controls to HVAC systems and solar projects. Whether you are looking to overcome budget constraints, conserve working capital or create positive cash flow, Graybar Financial Services is here to help. Utilize financing to show how your EE project can pay for itself from day one!

Attention Contractors:

Read this fact sheet to learn how you can find new opportunities with LED lighting.

Data and Computer Networking

Graybar Financial Services (GFS) provides simplified financing solutions nationwide for a wide range of Data and Computer Networking products, services, and maintenance and installation costs. Unlike other financing programs, GFS will not limit your ability to finance products from multiple manufactures.

Products Financed:

Computers, Servers, Wireless Equipment, Passive Optical Networks, Structured Cabling, Power Distribution, Distributed Antenna Systems (DAS), Cooling, Raised Flooring, Racks and Cabinets

When it comes to purchasing new data and networking equipment for your office location or data center you can rely on GFS for a simple and flexible financing solution. Our streamlined approach, starting with our financing quote tool, quick credit decisions, and simple documentation will provide the quick turnaround needed to expedite a project. GFS can provide the funding needed for a business’s immediate technology needs without the large upfront capital investment.

State and Local Government Financing

Graybar Financial Services provides financing programs to the State and Local Government (SLG) market place for tax-exempt equipment acquisitions. Our SLG product provides municipalities with an alternative method to acquire equipment instead of relying on bond referendums or a cash purchase. One of the unique features of the SLG lease is a "fiscal funding out" clause, which permits local governments to cancel the lease at the end of each fiscal year if funds are not appropriated for the next fiscal year.

What is a tax-exempt lease?

A tax-exempt lease or lease-purchase agreement is an installment purchase, conditional sale or lease with an option to purchase for nominal value. It may also be referred to as a municipal lease.

Who qualifies for tax-exempt financing?

The issuer of a tax-exempt obligation, including a tax-exempt lease, must be a State or possession of the U.S., the District of Columbia, or a political subdivision thereof. Political subdivisions include cities, towns, counties and other municipalities. They may include state entities such as school districts, special purpose districts (fire, parks, utility, water, etc.), hospitals, agencies, authorities, boards and commissions. Not-for-profit organizations created under Section 501 (c) (3) of the Internal Revenue Code do not qualify directly as issuers of tax-exempt obligations but may be eligible with a sponsoring governmental unit. Not-for-profit organizations benefiting from tax-exempt leasing include:

- Health Care (Hospitals, Clinics, Nursing Homes, Life Care Centers)

- Education (Colleges and Universities, Preparatory Schools)

- Museums

- Research Centers

What are some of the benefits of tax-exempt leasing?

The benefits of a tax-exempt lease include:

- Low rates resulting from tax-exempt basisc

- Preservation of capital dollars for other projects for which leasing is not optional

- Preservation of debt limitations does not create long-term debt on the entity’s books

- Enables improvement of cash flow

- Incorporates flexible structuring to meet budget needs

- Offers an alternative financing option without voter approval

- Provides 100% project financing (including soft costs)

Products

GFS can finance a wide range of commercial equipment including: Lighting and lighting controls, motor control, solar, power systems, building automation, data centers, security, mobility/wireless, unified communications, notification, audio/video, network infrastructure and services.

Contact us to learn more about how our team can help support your financing needs today.

Working Capital Loan

Whether you need to purchase additional inventory, expand your business or increase your cash flow, a working capital loan through Graybar Financial Services® (GFS) can help.

A working capital loan is an unsecured debt; it will not require the collateral needed with a bank loan. This should increase your likelihood of securing capital. GFS can help provide your business with a working capital loan starting at $5,000. Here are some of the benefits:

- No hidden fees or long-term commitment

- Flexible terms ranging from 6-12 months

- Cash received in as few as five days

- Flexibility for additional capital

- No restrictions on how the loan is utilized

Unified Communication Leasing and Financing

Graybar Financial Services (GFS) provides simplified financing solutions nationwide for a wide range of telecommunication products and services including voice communications, VOIP, wireless, hosted and ancillary systems. Unlike other financing programs, GFS will not limit your ability to finance products from multiple manufactures.

When it comes to purchasing new equipment you can depend on GFS for a simple and flexible financing solution. The straightforward GFS approach, starting with our financing quote tool, quick credit decisions, competitive rates, and simple documentation will expedite the decision making and purchasing process. GFS can provide the funding for a business’s immediate technology needs without the large upfront capital investment.

Tools and Test Equipment Leasing and Financing

When considering new tools and test equipment acquisitions you can count on Graybar Financial Services (GFS) for simple and flexible financing solutions. GFS specializes in providing competitive, value added financing solutions to commercial and government customers. Graybar provides flexible purchasing solutions so that you can focus on selecting the right equipment.

Do not lose a job because you do not have the capital to purchase the tools or test equipment needed to do the installation!

Do not pay the high cost of renting equipment without the ability to take ownership!

Our streamlined approach, starting with our Quick Quote App, quick credit decisions, and simple documentation will provide the quick turnaround needed to expedite the decision making process. GFS can provide the funding needed for a business’s immediate tool and test equipment needs without the large upfront capital investment.

Contact us to learn more about how our team can help support your financing needs today.

GFS Rental Program

Take control of your end-of-lease equipment.

Once your customer reaches the end of their lease term, Graybar Financial Services allows you to keep generating income throughout the full life of the equipment.

- We can continue to bill and collect payments for you beyond the initial term

- You control the end-of-lease purchase price and buy out to the customer

- Gain renewal revenue and control the end-of-lease purchase price to the customer

- At the end of the lease term the equipment is yours to keep, sell or rent again

Package all of the components your customers' need – installation, software, professional services, maintenance and more – into a single monthly payment. Often these extra features carry high yields that boost your sales and your commission. Also, these incremental items will increase your customers' satisfaction and differentiate you from the competition.

Industrial Equipment Leasing and Financing

When considering new industrial equipment acquisitions you can count on Graybar Financial Services for simple and flexible financing solutions. GFS specializes in providing competitive, value added financing solutions to industrial customers. Our mission is to make the financing process seamless so that you can focus on selecting the right equipment.

Do you need new equipment and machinery but lack the budget?

As an equipment financing generalist, Graybar Financial Services has the ability to finance a wide range of equipment and machinery to all the different business that fall under the label "industrial":

Automotive

Chemical Processing

Electrical Equipment OEM

Food and Beverage

Machine Builder OEM

Metals

Mining

Oil and Gas

Panel Builder

Pharmaceutical and Biotech

Power Generation

Printing and Publishing

Pulp and Paper

Water and Wastewater

Our streamlined approach, starting with our proposal generator, quick credit decisions, and simple documentation will provide the quick turnaround needed to expedite the decision making process. GFS can provide the funding needed for a business’s immediate tool and test equipment needs without the large upfront capital investment.